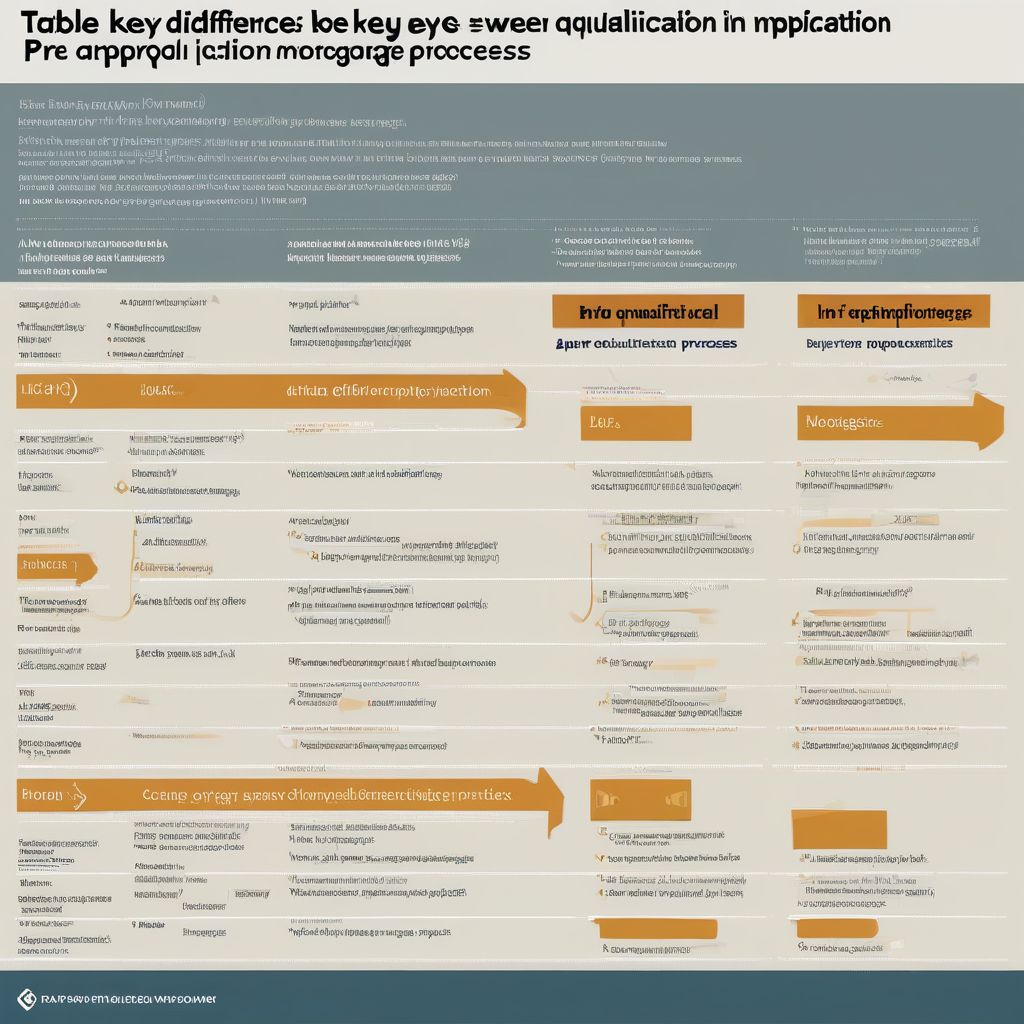

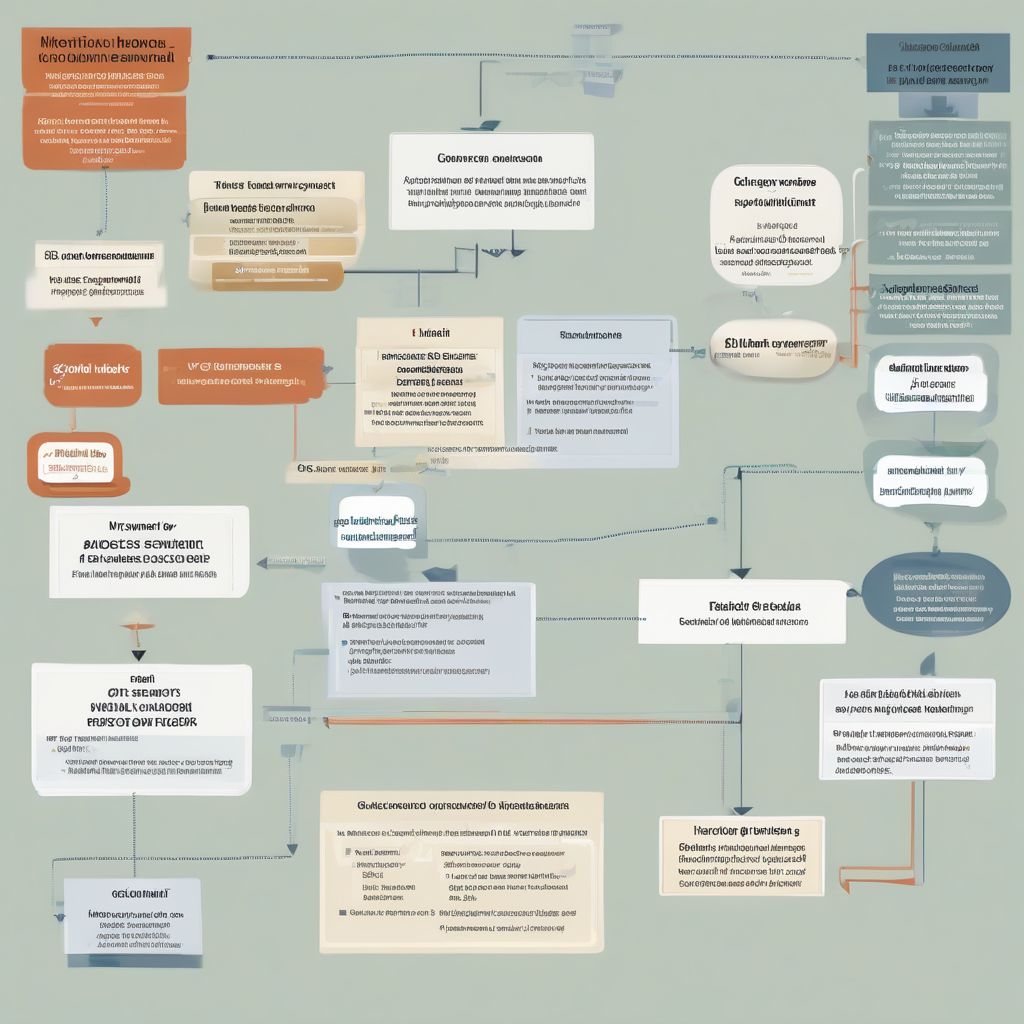

Mortgage Pre-Approval vs. Pre-Qualification: Understanding the Difference

When you’re getting ready to embark on a home-buying journey, securing a mortgage is a crucial step. Before diving into house hunting, it’s highly recommended to understand the difference between mortgage pre-qualification and pre-approval. While they might sound similar, these two processes serve distinct purposes and hold different weights in your quest for the perfect… Read More »